As a fundraiser you’ve probably heard it before: crowdfunding. Did you know that in 2011 almost $ 1.5 billion was raised through crowdfunding platforms worldwide? And the sky seems to be the limit with this fundraising technique.

Experts expect the total funding volume to grow with 91% (!) in 2012. Approximately half of this volume is to be raised through charity crowdfunding. Or: donation-based and reward-based crowdfunding, the two most common ways for charities. Charity crowdfunding is not only a great way to raise funds, but also a very smart way to raise (and involve) friends.

For those who’d like to fresh up their memory first, let’s start with an introduction of this fundraising technique: crowdfunding is a collective effort of a group of individuals who network and pool their resources for a specific project initiated by other people. This is usually done via or with the help of the Internet. Single projects are financed with small contributions from a large number of individuals.

Before you decide to jump on the crowdfunding train, it’s good to know what’s in it for you as a fundraiser. That’s why I’ve asked Ronald Kleverlaan to provide you with some answers. Ronald is a crowdfunding specialist and co-founder of WEBclusive, the leading crowdfunding software company in Europe. Their software raised millions of euros for more then 500 successful crowdfunding campaigns.

Before you decide to jump on the crowdfunding train, it’s good to know what’s in it for you as a fundraiser. That’s why I’ve asked Ronald Kleverlaan to provide you with some answers. Ronald is a crowdfunding specialist and co-founder of WEBclusive, the leading crowdfunding software company in Europe. Their software raised millions of euros for more then 500 successful crowdfunding campaigns.And don’t forget to think of what’s in it for your donors. So, let me help you with that.

1. Increase donor involvement

Ronald: “With charity crowdfunding, it’s all about earmarked giving. I understand that, for a lot of organizations, this will be a bit of a challenge. But in order to be successful, you need to pick a specific project, or a series of projects. You also need to set up a time frame in which the funds need to be raised. In my experience donors want to be involved with an urgent case, not ‘just’ an organization.”

Ronald: “With charity crowdfunding, it’s all about earmarked giving. I understand that, for a lot of organizations, this will be a bit of a challenge. But in order to be successful, you need to pick a specific project, or a series of projects. You also need to set up a time frame in which the funds need to be raised. In my experience donors want to be involved with an urgent case, not ‘just’ an organization.” Vera: “For charities, crowdfunding can be a great way to act as a ‘matchmaker’ between donors and the subjects (or: projects) they care about. Donors often experience the digital platform as the gateway to direct contact with project leaders and/or beneficiaries. Providing information to donors on a project basis beats the effect of a general newsletter, by far. You can send your donors updates about the preparations of the project, the ongoing activities, and the results as well.”

Vera: “For charities, crowdfunding can be a great way to act as a ‘matchmaker’ between donors and the subjects (or: projects) they care about. Donors often experience the digital platform as the gateway to direct contact with project leaders and/or beneficiaries. Providing information to donors on a project basis beats the effect of a general newsletter, by far. You can send your donors updates about the preparations of the project, the ongoing activities, and the results as well.”

2. Gain trust via (financial) transparency

Ronald: “Being (financially) transparent as a charity is very important to gain the trust of your donors. Raising funds on a project basis creates the opportunity to communicate about the results of a single project. For charities, this is often easier than measuring and showing the effect of the overall work of the organization.”

Ronald: “Being (financially) transparent as a charity is very important to gain the trust of your donors. Raising funds on a project basis creates the opportunity to communicate about the results of a single project. For charities, this is often easier than measuring and showing the effect of the overall work of the organization.”

Vera:  “It’s pretty simple, actually. More and more often, donors want to know where their money is spent on by a charity. They want to be assured that this money is put to good use. Lots of crowdfunding platforms show financial results of single fundraising projects on a daily basis, as well as the number of days that are left to raise the money, and the total amount needed per project. How transparent can you get?”

“It’s pretty simple, actually. More and more often, donors want to know where their money is spent on by a charity. They want to be assured that this money is put to good use. Lots of crowdfunding platforms show financial results of single fundraising projects on a daily basis, as well as the number of days that are left to raise the money, and the total amount needed per project. How transparent can you get?”

“It’s pretty simple, actually. More and more often, donors want to know where their money is spent on by a charity. They want to be assured that this money is put to good use. Lots of crowdfunding platforms show financial results of single fundraising projects on a daily basis, as well as the number of days that are left to raise the money, and the total amount needed per project. How transparent can you get?”

“It’s pretty simple, actually. More and more often, donors want to know where their money is spent on by a charity. They want to be assured that this money is put to good use. Lots of crowdfunding platforms show financial results of single fundraising projects on a daily basis, as well as the number of days that are left to raise the money, and the total amount needed per project. How transparent can you get?”

3. Connect donors to beneficiaries

Ronald: “People give to people. Not to mission statements, or to well written fundraising strategies. But not ‘just’ people; they like to support people with dreams or ambitious goals. Charity crowdfunding platforms provide the chance for donors to get in contact with project leaders and their dreams and to support the people with similar dreams.”

Ronald: “People give to people. Not to mission statements, or to well written fundraising strategies. But not ‘just’ people; they like to support people with dreams or ambitious goals. Charity crowdfunding platforms provide the chance for donors to get in contact with project leaders and their dreams and to support the people with similar dreams.”

Vera:  “But that’s not all. This online fundraising platform is also a great way to (digitally) introduce your friends to the projects (or: dreams) you have as a donor. Think of all the prospecting chances you have as a charity, when you provide an online platform for these friends to copy your donors’ philanthropic behavior.”

“But that’s not all. This online fundraising platform is also a great way to (digitally) introduce your friends to the projects (or: dreams) you have as a donor. Think of all the prospecting chances you have as a charity, when you provide an online platform for these friends to copy your donors’ philanthropic behavior.”

“But that’s not all. This online fundraising platform is also a great way to (digitally) introduce your friends to the projects (or: dreams) you have as a donor. Think of all the prospecting chances you have as a charity, when you provide an online platform for these friends to copy your donors’ philanthropic behavior.”

“But that’s not all. This online fundraising platform is also a great way to (digitally) introduce your friends to the projects (or: dreams) you have as a donor. Think of all the prospecting chances you have as a charity, when you provide an online platform for these friends to copy your donors’ philanthropic behavior.”

4. Direct support

Ronald: “I often hear charities talk about the struggle they experience with connecting donors on a long term basis. Well, the thing is: I’m afraid this won’t get any easier in the (near) future. To me, charity crowdfunding is the perfect solution for both the charity as the donor. As a charity you have the opportunity to introduce project after project. Which – funny enough – provides a chance to stimulate structural giving, in a sense, after all.”

Ronald: “I often hear charities talk about the struggle they experience with connecting donors on a long term basis. Well, the thing is: I’m afraid this won’t get any easier in the (near) future. To me, charity crowdfunding is the perfect solution for both the charity as the donor. As a charity you have the opportunity to introduce project after project. Which – funny enough – provides a chance to stimulate structural giving, in a sense, after all.”

Vera:  “Whether it’s about major giving or regular giving, more and more often I hear donors say that – whenever they’ve decided to donate – they want to see the impact of their gift; the sooner the better. And this is exactly why charity crowdfunding is booming business. To these donors, charity crowdfunding provides a platform of numerous short term, easy to measure, soon to be activated projects. And this is exactly what they need.”

“Whether it’s about major giving or regular giving, more and more often I hear donors say that – whenever they’ve decided to donate – they want to see the impact of their gift; the sooner the better. And this is exactly why charity crowdfunding is booming business. To these donors, charity crowdfunding provides a platform of numerous short term, easy to measure, soon to be activated projects. And this is exactly what they need.”

“Whether it’s about major giving or regular giving, more and more often I hear donors say that – whenever they’ve decided to donate – they want to see the impact of their gift; the sooner the better. And this is exactly why charity crowdfunding is booming business. To these donors, charity crowdfunding provides a platform of numerous short term, easy to measure, soon to be activated projects. And this is exactly what they need.”

“Whether it’s about major giving or regular giving, more and more often I hear donors say that – whenever they’ve decided to donate – they want to see the impact of their gift; the sooner the better. And this is exactly why charity crowdfunding is booming business. To these donors, charity crowdfunding provides a platform of numerous short term, easy to measure, soon to be activated projects. And this is exactly what they need.”

5. Return on involvement

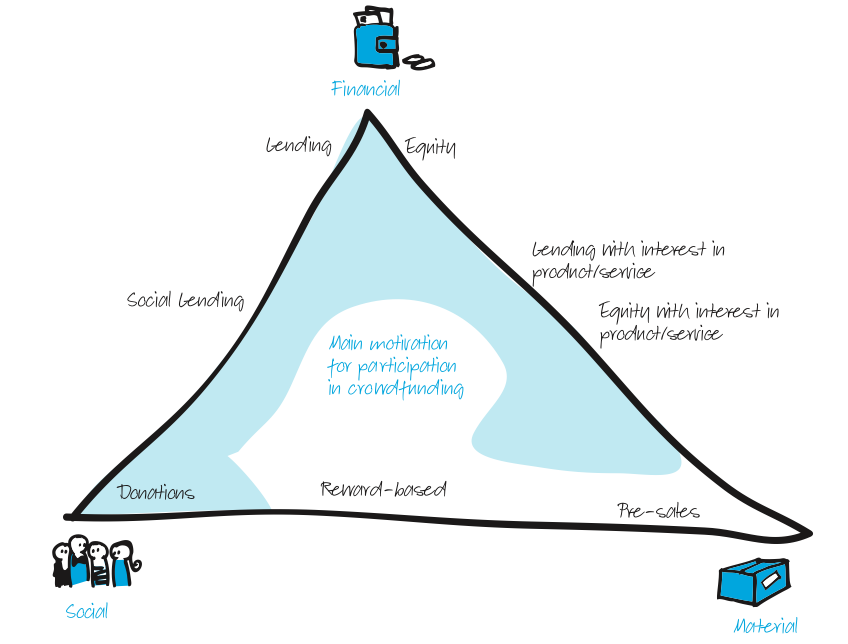

Ronald: “I hear organizations talk about Return on Investment. Well, with charity crowdfunding I’d rather talk about Return on Involvement. To explain this, I often use this model (see picture below).

Ronald: “I hear organizations talk about Return on Investment. Well, with charity crowdfunding I’d rather talk about Return on Involvement. To explain this, I often use this model (see picture below).

With a crowdfunding campaign it is important to think about what people want in return for their support. In general three different categories of returns can be identified: social return (good feeling), material return (pre-sales of a product) or financial return. Although charities normally only focus on the social return, it can be really interesting for them to look into other type of crowdfunding models, like reward-based crowdfunding (small or special gifts as return) of social loans (a loan with 0% interest)."

Vera: “It’s true. Sometimes people are triggered to donate (more) by the option of receiving rewards. They don’t want you begging on your knees to thank them, or bringing them flowers personally. But receiving behind-the-scenes tickets for a band repetition, handwritten letters of beneficiaries, or a phone call from a project leader can add just that little bit extra to the feeling that you’re really connected to a project, as a donor.”

“It’s true. Sometimes people are triggered to donate (more) by the option of receiving rewards. They don’t want you begging on your knees to thank them, or bringing them flowers personally. But receiving behind-the-scenes tickets for a band repetition, handwritten letters of beneficiaries, or a phone call from a project leader can add just that little bit extra to the feeling that you’re really connected to a project, as a donor.”

“It’s true. Sometimes people are triggered to donate (more) by the option of receiving rewards. They don’t want you begging on your knees to thank them, or bringing them flowers personally. But receiving behind-the-scenes tickets for a band repetition, handwritten letters of beneficiaries, or a phone call from a project leader can add just that little bit extra to the feeling that you’re really connected to a project, as a donor.”

“It’s true. Sometimes people are triggered to donate (more) by the option of receiving rewards. They don’t want you begging on your knees to thank them, or bringing them flowers personally. But receiving behind-the-scenes tickets for a band repetition, handwritten letters of beneficiaries, or a phone call from a project leader can add just that little bit extra to the feeling that you’re really connected to a project, as a donor.”

Most charity crowdfunding projects are based on an all-or-nothing strategy; if the financial goal is not reached, the project won’t be activated. Although this can be experienced as a risk for the charity, it’s often seen as a chance for the donor. Most of the time it stimulates both the charity as the donor to walk the extra mile, to make sure the project goals will be reached. And, isn’t this what we all want, in the end?

Need some charity crowdfunding inspiration? For some Dutch examples, check:

- www.voordekunst.nl (rewards)

- www.1procentclub.nl (donations)

- www.pifworld.org (donations)

- www.getitdone.org

For European (non-Dutch) examples, check:

- www.justgiving.com (donations)

- www.ulule.com (rewards)

For US examples, check:

- www.kickstarter.com (rewards and pre-sales)

- www.kiva.org (social loans)

- www.causes.com (donations)

- www.indiegogo.com

Ronald Kleverlaan founded the Dutch Crowdfunding Roundtable and speaks and writes about crowdfunding at international conferences. Ronald has lived and worked in The Netherlands, Brazil, Malaysia and Vietnam. He is also co-founder of the European Crowdfunding Network.

Deze reactie is verwijderd door de auteur.

BeantwoordenVerwijderen